How your credit score can boost the cost of borrowing

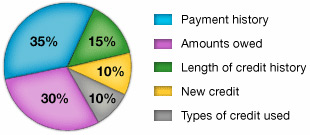

The FICO score is named after Fair Isaac Corp., the company that developed and licenses the secret formula that is used almost universally to determine a person’s creditworthiness. It’s a number ranging from 300 to 850 and, although we don’t know the proprietary calculations involved, the pie chart below shows an approximate weighting of the factors that are used.

Significance

The importance of having a good score is dramatically shown in the next chart, which lists a recent national average interest rate that was charged for a 3-year automobile loan:

| FICO Score | Interest Rate |

| 720-850 | 7.137% |

| 690-719 | 7.936 |

| 660-689 | 9.468 |

| 620-659 | 11.095 |

| 590-619 | 14.448 |

| 500-589 | 15.129 |

(Source: myfico.com web site)

Improving your scoreWhile a dramatic event such as bankruptcy can cause your score to plunge, increasing your score takes time. Here are a few things you should be doing:

- Make at least the minimum payment on all of your accounts. One delinquent account and two fully paid up accounts are worse than three current ones.

- If you need to get rid of credit cards, cut up the newest ones first – a long-standing account is better than a newer one.

- Don’t open new credit accounts unnecessarily. However, if the only way you can make progress in paying off balances is to consolidate into a lower interest rate loan or card, go for it.

- Don’t shop for credit unless you really need it. Even an inquiry by a lender can adversely affect your score.

More tips than we have room for here can be found on the FICO web site:http://www.myfico.com/.