Investing in real estate — the REIT advantage

Real estate offers an attractive supplement to traditional stock, bond and mutual fund investments. It’s tangible and usually more stable than stock and bond prices and often has a low correlation with them.

You can invest directly in real estate via your personal residence or by buying rental property. Both offer the opportunity for capital appreciation and tax benefits, and rental units can also provide income. But rental property requires a lot of work to manage properly and carries risks such as property damage and empty apartments. But the biggest drawback is the lack of diversification.

Real Estate Investment Trusts

Real Estate Investment Trusts

A REIT is a company that primarily invests in and manages real estate. In the U.S. a company choosing the REIT structure must by law distribute at least 90% of its earnings to shareholders (laws vary in other countries). In return, the REIT is not taxed on those earnings that are passed through to the investor, but the shareowner is taxed at ordinary income tax rates (rather than the lower qualified dividend rate). Because of this they are well suited to a tax-sheltered account such as an IRA.

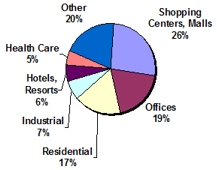

A REIT may specialize in a particular type of investment (see pie chart) or may invest in multiple types. The latter are included in the “Other” category in the chart. They usually also invest over a wide geographic area, including outside the U.S.

Investors can buy individual REITs, which is similar to buying individual stocks, or purchase mutual funds or ETFs which hold a pool of REITs for even more diversification.

Mentor Capital frequently uses REITs and REIT funds—all of which are very liquid investments—as part of its asset-allocation process.