Save money by raising your Credit Score

Your credit score significantly impacts your finances in many ways –for example, the interest rate you pay on your mortgage, how much your auto insurance premiums are, and whether or not you can even obtain approval for a mortgage or other credit.

Your credit scores – which can range from 350 to 850 – are based on the information in your credit reports. Last month’s newsletter included information about how you can order free credit reports annually from the three major credit agencies, and reviewing those reports is crucial if you want to raise your credit scores. While those three credit agencies supply credit scores, the industry standard is the FICO credit score issued by Fair Isaac Co.

To raise your credit scores, consider doing the following:

- Review your credit reports each year, and work with the agencies to correct erroneous information in your reports.

- Use less of your available credit, preferably under 30%. While you can ask your credit issuers to raise your credit limits, you’re better off paying off the existing balances each month.

- Keep existing accounts – even those you no longer use – open and in good standing, preferably with small or zero balances. (Ironically, not having credit cards hurts your credit score because of no or little credit history.)

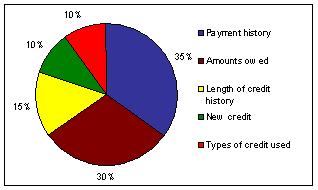

- Pay all bills and fines promptly. 35% of your credit score is based on your payment history, which includes such things as parking tickets and library fines.